By Koh Fujimoto

Support cross-border life

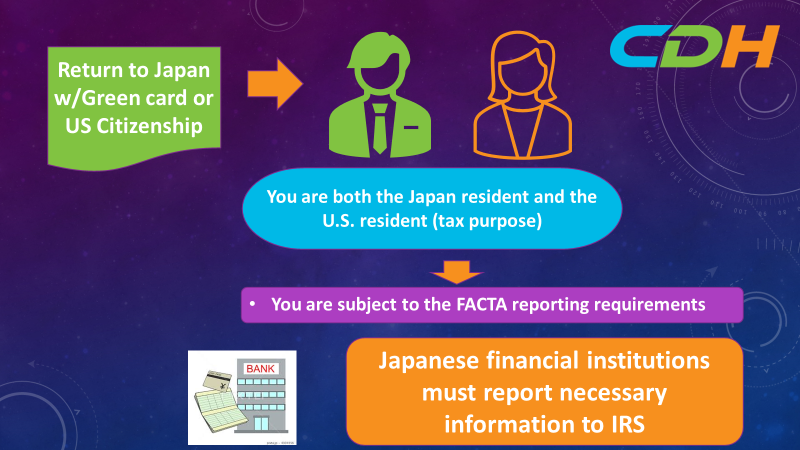

When U.S. green card holders and U.S. citizens open bank accounts in Japan, they face increasing difficulties. In this article, I describe the types of issues, reasoning why they face such issues, and how to cope with them.

- Issues:

The common issues are the time that takes to open bank accounts and the information required to open an account. Japanese financial institutions often advertise how easy it is to open an account to the general public. I saw several answers that it takes a minimum of half-day. However, if you are a U.S. citizen or a U.S. green card holder, it may take up to four (4) months to open an account. Also, a bank will ask you to provide numerous documentations including certain narratives about why you are moving to Japan. The information request can be overwhelming. - Reasons:

Japanese financial institutions must comply with the U.S. law called FATCA (Foreign Account Tax Compliance Act)[i] This law requires that foreign financial institutions and certain non-financial foreign entities report on the foreign assets held by their U.S. person. The U.S. person is those who are U.S. citizens, U.S. green card holders, and U.S. residents by various immigration visas. If financial institutions fail to disclose the information to the IRS, they face hefty fines and consequences.

As a result, you will find almost all Japanese banks have a page dedicated to their websites about FATCA requirements. One bank says that it must report the name, tax identification number (SSN), account number, maximum account balance, and interest income to IRS regularly. [ii] In addition, the banks require you to fill out the Form W-9. [iii]

I suspect that certain major financial institutions understand the requirements very well. However, there are numerous local and small financial institutions that you may want to open an account for. They may not be that familiar with the rules. As a result, you may face a longer waiting period and see several confusing employees struggling with the FATCA. In that case, your wait time only becomes longer. - How to Cope with the Issues:

For a green card holder, if you give up your green cardholder status, then, you are no longer a U.S. person and the bank does not have to report you under FATCA. Therefore, one way to avoid the above issues, you may want to return your green card to the USCIS before trying to open an account.

For a U.S. citizen, the process is much more involved to give up citizenship. Many will prefer keeping the citizenship to a longer wait time.

I recommend that those who want to open accounts be patient and understandable why Japanese banks must comply with the FATCA rules. To comply with such rules, the banks incur significant costs compared to the profit that they can earn from your bank accounts. I suspect that such costs significantly outweigh the profits.

Once you can open an account, I believe that you should be able to receive the same time and quality service that the Japanese residents receive. In short, if you can be patient for the first several months, you will be fine.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them.

https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.

[i] https://www.irs.gov/businesses/corporations/foreign-account-tax-compliance-act-fatca

[ii] https://www.bk.mufg.jp/ippan/law/fatca.html

[iii] https://www.irs.gov/pub/irs-pdf/fw9.pdf