By Koh Fujimoto

Support Cross-Border Life

Cross Border Inheritance gives headaches even to professionals. My mission is to explain the essence of the matter in plain English. I consider the U.S. federal tax only here in this article.

- Case

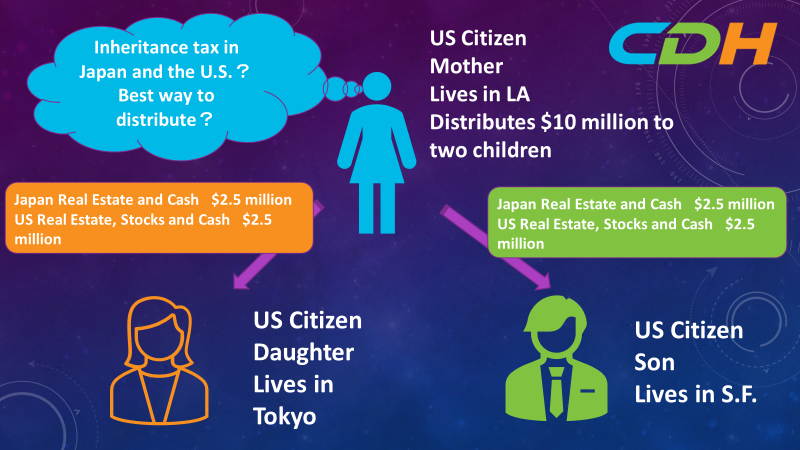

A U.S. citizen mother has two children. She wants to eventually distribute her assets to them. Her total assets amount to $10 million. A daughter is a U.S. citizen and lives in Tokyo. A son is also a U.S. citizen, and lives in San Francisco. The mother and her son have not established residence in Japan for the last ten years.

Mother has $5 million in Japan in the form of real estate and cash. She also has $5 million in the U.S. in the form of real estate, stocks, and cash.

Let’s start thinking of the best way to distribute her assets. First, let’s review what the mother wants to do.

The mother wants to give an equal portion of her estate to her children. She wants to give $5 million ($2.5 million of her Japan assets and $2.5 million of her U.S. assets) to her son. She also wants to give $5 million ($2.5 million of her Japan assets and $2.5 million of her U.S. assets) to her daughter.

- Son

Since the mother and the son are U.S. residents and have not established residency in Japan for the last ten years, the Japanese tax authority only can tax his Japanese assets of $2.5 million.

The mother is not likely to be subject to the U.S. federal estate tax because her estate does not reach the federal lifetime gift/estate tax exemption amount of $11.7 million (in 2021). - Daughter

The daughter is a Japanese resident, and the Japanese tax authority can tax her entire inherited assets of $5 million. Both the U.S. assets of $2.5 million and the Japanese assets of $2.5 million will be subject to the Japanese inheritance tax.

There will be no U.S. federal estate tax because of the lifetime exemption amount. - Planning

In this case, the amount of the assets that become subject to the Japanese inheritance tax is $7.5 million. It consists of the son’s $2.5 million and the daughter’s $5 million.

Let’s think of a case where the mother distributes the entire Japanese assets of $5 million to the daughter, and she also distributes the entire U.S. assets of $5 million to her son. In this case, the Japanese government only can tax the Japanese assets of $5 million.

If the mother chooses this way, she can exclude $2.5 million of her assets out from the reach of the Japanese tax authority. This gives a substantial tax saving to her estate.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them.

https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.