Supports Cross Border Professionals and Families

Under the IRC Section 101(a)(1), beneficiaries generally do not pay taxes to the life insurance proceeds in the U.S. When you move to a foreign country; this may not be true. I specifically talk about this in Japan.

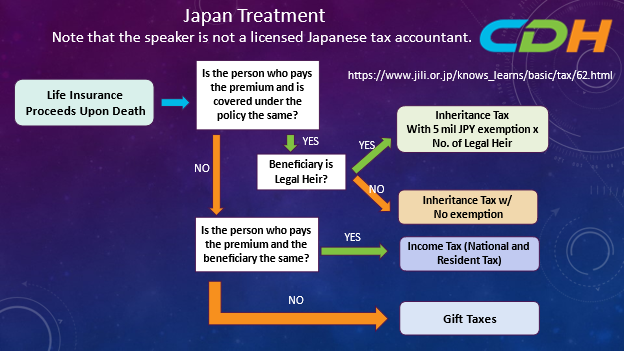

Below is a summary of how the life insurance proceeds are taxed in Japan. I reviewed one website and translated the relevant section into English. The original site address is as follows: https://www.jili.or.jp/knows_learns/basic/tax/62.html. Please note that I am not a Japanese licensed tax accountant.

As you can see, you must answer at least two questions to get to a final result. In general, the proceeds will be taxable in Japan in one way or another. Beneficiaries must pay inheritance tax or income tax, or gift taxes. Given generally higher tax rates in Japan, the price you must pay becomes expensive.

Let’s assume that you move with your spouse permanently to Japan. Then, you pass away. You have an insurance policy with a U.S. insurance company. You designated your son as your sole beneficiary. You paid your premium. Even if your son lives in the U.S., I believe the Japanese government wants your son to pay the inheritance tax because you are a Japanese tax resident at the time of death. Your original intent of giving your son tax-free money is now defeated.

My point here is clear. You must consult a qualified local country’s tax accountant before moving because there may be expensive tax consequences. The U.S. has favorable tax rules to life insurance, but it does not mean that you can keep those benefits after you move to another country. I recommend you to do a solid pre-immigration planning.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]