Support cross-border life

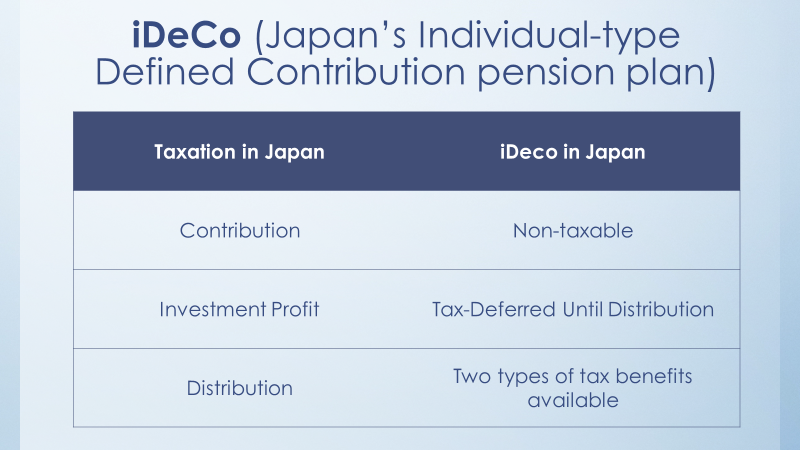

From May 2022, if your Japanese spouse participates in Japan’s National Pension, he or she becomes eligible to participate in iDeCo. [i] (I am going to use “she”.) iDeCo’s name came from an Individual-type Defined Contribution pension plan. iDeCo is similar to the U.S. traditional IRA. One can set up her individual iDeCo and individually manage her investment. There are tax benefits for contribution, investment profits, and distributions.

Under Japanese taxation, she can exclude her contributions from her taxable income, she can defer her investment profits until distribution, and she can take two types of tax benefits depending on how she receives the distributions.

One requirement for this individual retirement plan is that one must be enrolled in Japan’s National Pension. To be able to enroll in the National Pension overseas, she must be a Japanese citizen. [ii]

Assume that your Japanese spouse has a desire to retire in Japan if she is left alone in the U.S. This investment option may be very attractive to her. I must be very careful how I phrase the sentence. With such caution, your Japanese spouse may benefit from the U.S. traditional IRA and Japan’s iDeCo. (Japanese version of traditional IRA).

However, you must be very careful how her contributions and the investment profits will be treated under the U.S. tax law. The United States does not unilaterally accept the qualified (tax-advantaged) status of most foreign retirement plans. [iii] I do not think that you can take a deduction for the contribution under the U.S. tax laws. I am also not sure how the U.S. tax laws treat investment income on iDeCo. Although, the Japanese financial institutions will not issue 1099 to IRS, and the IRS will not know the amount of the investment income generated in iDeCo.

If your Japanese spouse plans to receive distributions in Japan, under the Japan-US tax treaty’s article 17, section 2, he or she will get taxed in his resident country (Japan). [iv]Thus, he or she can enjoy the benefits of iDeCo.

At present, I find no details available on how a Japanese citizen living in foreign countries can set up an account with a Japanese financial institution. As the U.S. government is sensitive to non-resident owning investment in the U.S., I believe that the same will apply to the Japanese government, then to the financial institutions. I advise anyone to analyze the situation carefully before making a decision.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.

[i] https://www.mhlw.go.jp/stf/seisakunitsuite/bunya/nenkin/nenkin/kyoshutsu/2020kaisei.html

[ii] https://www.nenkin.go.jp/service/kokunen/kanyu/20140627-02.html

[iii] “The Cross-Border Family Wealth GUIDE: by Andrew Fisher, Page 92. Published by Wiley

[iv] https://www.treasury.gov/resource-center/tax-policy/treaties/Documents/japantreaty.pdf