By Koh Fujimoto

Support cross-border life

Do you plan to move to Japan for your retirement with your Japanese spouse? There are, in fact, many couples who want to move to Japan. Many think of high-quality medical service and low-cost medical and long-term care insurance as their primary reasons.

However, the highest rate of Japan’s inheritance tax is a whopping 55%. And, its basic exemption amount is only at 30,000,000 Japanese Yen (approximately $300k). The high inheritance and gift tax rates have been the stopping point for many couples with substantial assets.

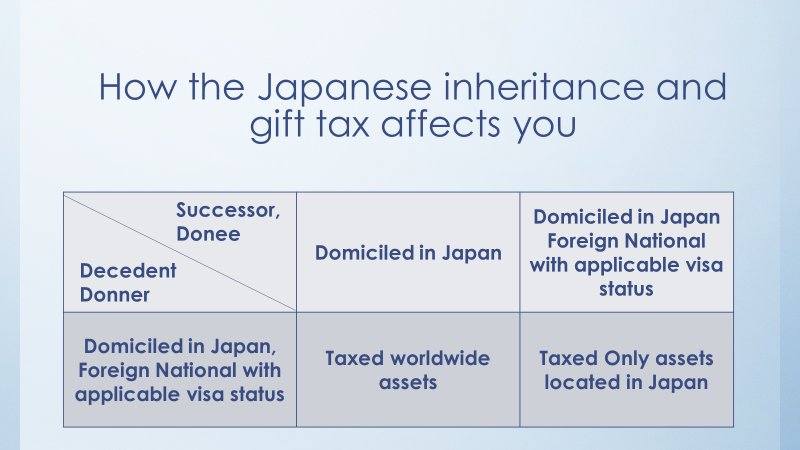

The Japanese government relaxed its rules a little on April 1, 2021. Under the new rules, if you live in Japan and have certain visa status, the government only taxes you the assets in Japan. In other words, if you keep most of your assets in the U.S., you can shield such assets from Japan’s tax.

The question is what is the definition of a foreign national with applicable visa status.

Unfortunately, based on my reading, this category does not include (1) a former Japanese citizen and (2) the spouse of a Japanese citizen. This category only appears as corporate ex-pat sent by a foreign corporation, professional athletes, and artists.

As a result, a retiring couple, including former Japanese citizens, does not fall into this category. If one of the spouses passes away, Japan taxes the worldwide assets of a decedent.

If the couple has children, they have an option of giving certain assets away to their U.S. resident’s children to reduce the size of their assets, and then, they can become the residents of Japan. The couple can minimize the potential impact of the ever stringent inheritance and gift tax by taking this action.

The government wants more corporate ex-pats, professional athletes, and artists to live in Japan, not ordinary American citizens. I do not know if this is good or bad. However, this is something to keep in mind for those who want to move to Japan.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce the video with the same topic on YouTube. Would you please search at CDH Accounting Office? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.