By Koh Fujimoto, Support cross-border life

In this article, I demonstrate how giving up Japanese citizenship affects taxation under the Japanese inheritance laws. In short, under the circumstance that I describe, the Japanese tax authority only can tax you your assets located in Japan.

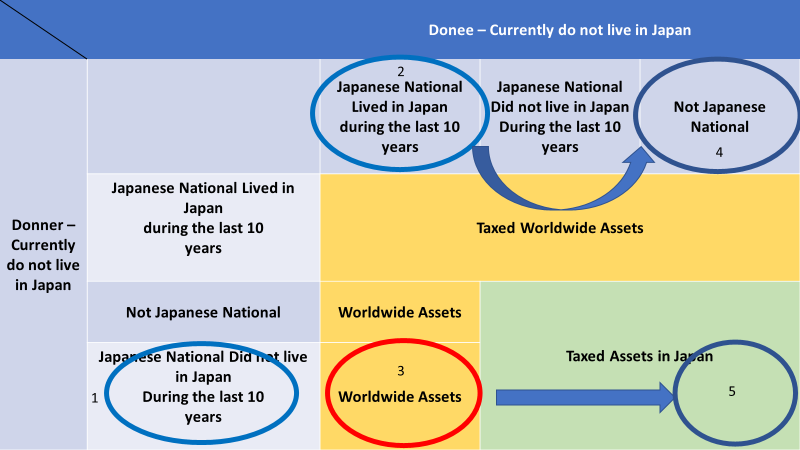

I have translated a part of the National Tax Authority’s chart for this article. You can find the original chart on the National Tax Authority’s website. [i]

In this case, the donner does not live in Japan. He did not live in Japan during the last ten years at the time of inheritance. The donner has substantial assets holdings in the U.S. and Japan. He is a Japanese national. See bottom left circle 1. The donee also does not currently live in Japan. He lives in the U.S. The donee is also a Japanese national.

A simple illustration is as follows:

A Japanese father has been working in the U.S. subsidiary for over 15 years. His son recently graduated from college in Japan. He married a U.S. spouse and lived together for three years in the U.S. as a green cardholder. His marital status remains the same today. The father is getting concerned about how his assets get taxed in Japan when he passes away, living in the U.S.

See circle 2. The son has lived in Japan for any part of the last ten years. (Seven years to be precise) Because of this condition, the Japan tax authority can tax his father’s worldwide assets (see circle 3). If the son, a donee, can move circle 3 to circle 5, the Japan tax authority can only tax his father’s assets in Japan.

To move circle 3 to circle 5, he can give up his Japanese citizenship and become a U.S. citizen. Under the Japanese nationality law, he will automatically lose his Japanese citizenship if he voluntarily obtains a foreign nationality. He has met the eligibility of becoming a U.S. citizen as he has been married to the U.S. citizen spouse for three years. [ii]This rule of the Japanese inheritance tax law also applies to their gift tax. If you are facing a similar situation today, this illustration might give you planning ideas. I suggest that you consult with the Japanese inheritance tax specialists to ensure that you correctly comply with the laws. CDH can refer you to the right specialist.

Changing the nationality to save some taxes does not sound prudent, in my opinion. One’s nationality has a lot more significance than the tax effects. Therefore, I also leave a note of mine. Give a good amount of thought about changing your nationality. It will be a significant decision in your life.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.

Resources:

[i] https://www.nta.go.jp/taxes/shiraberu/taxanswer/zoyo/4432.htm

[ii] https://www.uscis.gov/citizenship/learn-about-citizenship/citizenship-and-naturalization/i-am-married-to-a-us-citizen