Annual tax returns. How are you filing them? Do you purchase tax preparation software, use filing agency services, or use an accounting firm?

1. Is the burden of filing work reduced?

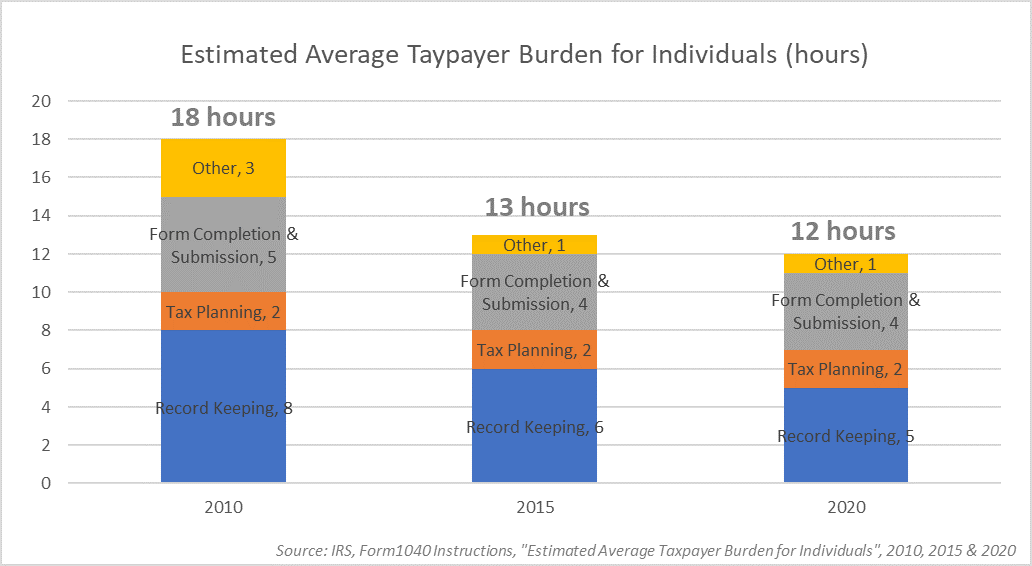

The IRS Form 1040 Instruction describes the estimated time (taxpayer burden) required to complete the tax return. The average estimated time for 1040 tax return preparation work in 2020 was 12 hours [i]. The breakdown is:

[Record management 5 hours] + [Tax planning 2 hours] + [Declaration preparation 4 hours] + [Other 1 hour] = 12 hours in total

This estimate is based on the IRS’s annual Taxpayer Compliance Burden Survey, which has different numbers each year [ii]. Looking at the time series, it took 50 percent longer 10 years ago than it does now, so it seems that the burden of our filing work is decreasing year by year. Is that your experience?

2.The most time-consuming preparation is Record Keeping.

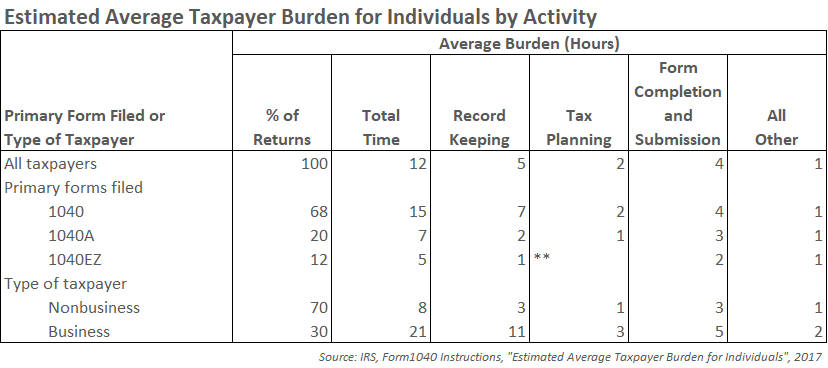

Of course, the average preparation time depends on the volume of the tax return. The figure below is a table summarizing the preparation time for each taxpayer by activity. Taxpayers who submit the long Form 1040, which is 68% of all 1040 taxpayers, spend an average of 15 hours preparing their tax returns, and half of that is record keeping (7 hours).

This is just an average, however. The trend is that record keeping is the most time-consuming part of preparation for any taxpayer, and ways to reduce the time spent on filing work involve accurate and efficient record management throughout the year. Also, accurate records are the best bet against IRS audits.

3. Make 12 hours fruitful.

It is seldom necessary for individuals to file tax returns in Japan, but in the United States, tax returns are obligatory for individuals. In the sense that taxpayers can proactively participate in their tax measures, it is a good idea to think of the 12 hours that they need to spend as an “opportunity” for tax savings rather than as a “burden”. In fact, since it is common for Americans to make financial plans with taxes in mind, doesn’t it make sense to spend the 12 hours as wisely as possible?

We don’t yet know how many hours of preparation the IRS will estimate for the tax year 2021, but it’s essential to continue managing records on a daily basis for next year.

Summary

- The time required to prepare a tax return has been reduced year by year, and currently averages 12 hours. 6 hours less than 10 years ago.

- About half the time spent is “record management”. Keeping accurate records throughout the year is important for both time savings and IRS audits.

- The 12 hours of tax return preparation is the culmination of year-round record management and tax planning. Let’s include it in next year’s financial plan.

If you have any questions regarding this article, please contact Motoe Haller at [email protected]. CDH provides tax filing services for cross-border US-Japan professionals and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. The intent of this article is to provide a basic overview of various tax matters, so please keep in mind that it is important to discuss your specific needs with tax and legal professionals when you decide to take action. Our YouTube cross-border channel covers and explains a lot of content. Please take a look. We also offer free consultations (booking link).