Supports Cross Border Professionals and Families

I discuss the general action plans when you face a potentially covered expatriate designation.

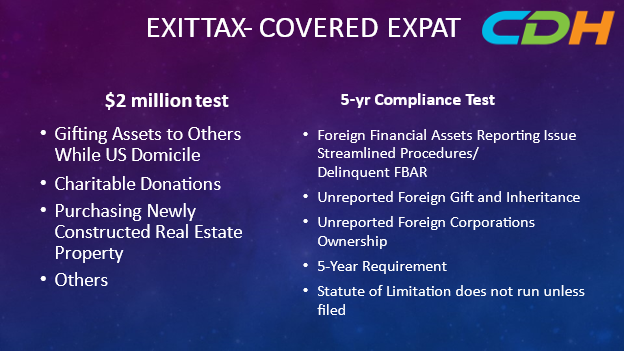

There are two main tests when the IRS determines if you are a covered expatriate. They are (1) a Two-million dollar Net Worth Test and (2) a 5-Yr Federal Income Tax Compliance Test.

- Two-million dollar Net Worth Test

When you abandon your green card or U.S. citizenship, you will become a covered expatriate if your worldwide net worth exceeds two million dollars. The best way to avoid this designation is to shift some of your assets to your spouse, family members, and others to make your asset less than $2 million. You must do this transfer when you are in a US domicile. Being a US domicile enables you to use unified credit. The 2023 agreeable credit amount is $12.92 million. Take advantage of this rule while you can. You pass this test if your net worth is less than $2 million. For instance, you and your spouse can have $1.9 million in assets, and you and your spouse will not be a covered expatriate.

There are a few cautions to note. The first is timing. You do not want to give assets in the year when you expatriate because you may not be in a US domicile. In addition, you wish to refrain from providing assets after moving to other countries because other countries may levy you a gift tax. In other words, you should shift your holdings as a bona fide US resident. This depends on which country you are moving to. You may need another research on that country’s gift tax.

You can also take advantage of charitable donations. You can reduce your assets, and you can reduce your taxable income when you donate. It gives you double tax benefits.

In certain countries, a newly constructed house or condominium’s value declines when one buys a property because it becomes a “used” property. Some may take advantage of this.

There are other methods, but it depends on your specific situation.

- 5-Yr Federal Income Tax Compliance Test

You must correct past federal tax issues before you expatriate. You must declare you have been in federal tax compliance for the five years preceding your expatriation year on Form 8854.

There are various ways to amend your past files, such as Streamlined Procedures, Delinquent FBAR Filing Procedures, Delinquent International Information Reporting Procedures, and filing standard amended tax returns. You can correct your past foreign financial account reporting issues, international reporting issues, and incorrect tax filings.

Generally, the IRS’s statute of limitation is three years after you file your returns. However, the rule of expatriation requires five years of compliance. You must amend the full five years of returns. In addition, if you fail to file returns, the statute of limitations has not run yet. You may need to file an ancient form to the IRS in such a case.

It would be best to have ample time to take these tax measures before you expatriate. I recommend planning early and hiring a competent cross-border professional to help you achieve your goals.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]