By Koh Fujimoto

Support cross-border life

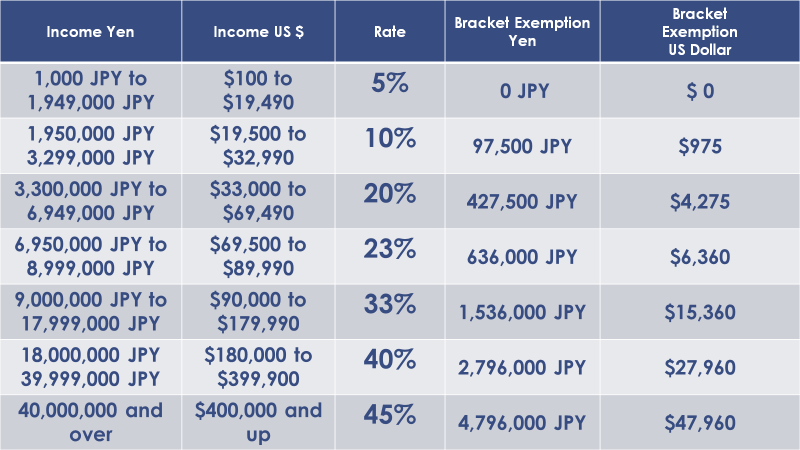

1, Income Tax Rates: I made this chart using the exchange rate of $1 equals 100 JPY. This is the tax rate table for the Japanese income tax rates. There is another important tax that you cannot forget besides the income tax. It is called “Jyuminzei.” It is a local tax, but the rate at 10% is uniform nationwide. In short, you must add 10% to the applicable rates above to see the big picture.

For example, if your income is $50,000, your effective tax rate is about 30% (income tax at 20% and the local tax at 10%). The highest income tax rate of Japan is 55% compared to 37% of the U.S. Another difference is that the above rates in the table are not marginal. The Japanese government applies the rate to the entire income. This is another significant difference compared to the U.S.

In general, it is safe to conclude that the Japanese rates are higher than the U.S. tax rates.

As a U.S. citizen, you are obligated to file Form 1040 and other required schedules including infamous foreign financial assets reporting, And, there is no guarantee that you can fully offset the Japanese income tax against the U.S. income taxes using the foreign tax credit. The calculation is complex, and I saw too many taxpayers who got disappointed about the effectiveness of the foreign tax credit systems.

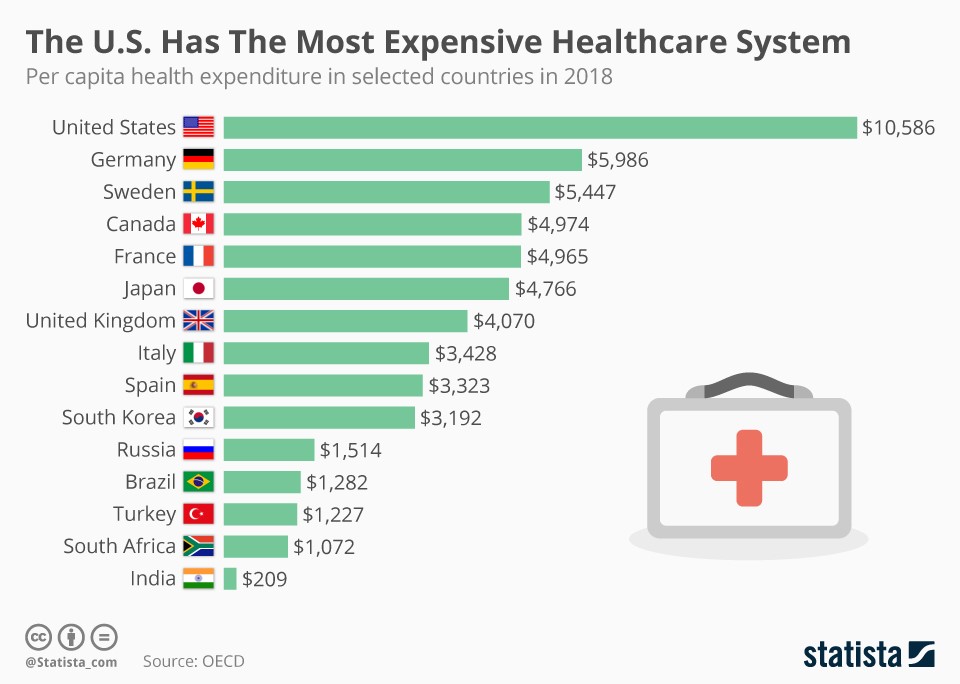

2, Medical Care and Medical Expenses: Yet, Japan provides both national health insurance and national long-term care insurance. Once you establish your residency in Japan, you are eligible for these benefits. I have first-hand experience of how well the government took care of my late parents. They did not have to pay much at all for their medical care. As you get older, you only need to pay a fraction of medical costs in Japan.

In addition, Japanese medical expenses are not expensive. See the chart below. [i]

3, Inheritance Tax: In Japan, it is paid by someone who inherits money or property from someone who has died. In Japan, it is paid as a national tax (between 10 and 55% after an exemption of ¥30 million ($300,000) + ¥6 million ($60,000) per heir is deducted from the estate). [ii] The 2021 U.S. lifetime gift and estate tax exemption are at $11.7 million. Please note that this is approximately 32 times higher than that of Japan. Your worldwide assets are in general subject to this tax as long as you are residing in Japan.

With the information above, do you still want to retire in Japan? If your loved spouse wants to go back to Japan to retire, why not going there with her? But, you would need a good amount of due diligence.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce the video with the same topic on YouTube. Would you please search at CDH Accounting Office? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.

[i] https://www.statista.com/chart/8658/health-spending-per-capita/

[ii] https://englishlawyersjapan.com/inheritance-tax-in-japan/