By Koh Fujimoto

Support cross-border life

If you are a US citizen who owns a Japanese company, you are subject to the very complex U.S. tax rules. Without going through the details of the rules, I focus on the danger of not consulting with appropriated tax professionals in this field.

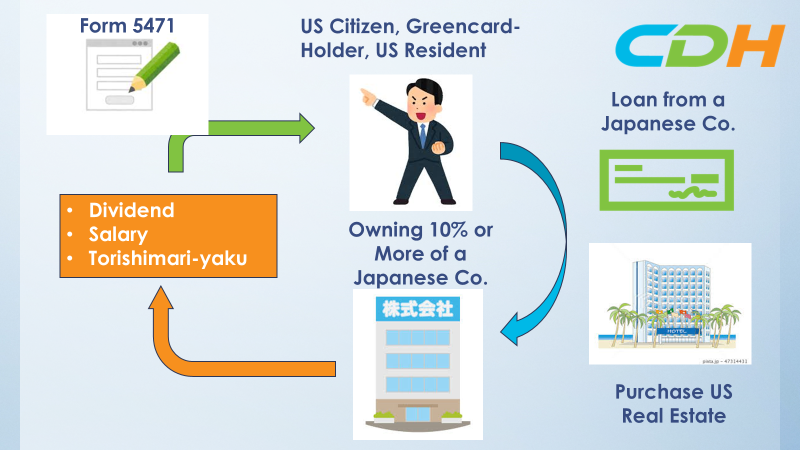

- Form 5471 ((Information Return of U.S. Persons With Respect To Certain Foreign Corporations)

This form is a very complex form to understand. One of the reasons why this form is very hard to understand is that it applies to both corporations and individuals. Multinational U.S. corporations can handle the rules as they can hire top-level international tax professionals. However, this form also applies to individuals who own small foreign companies.

In general, if you own 10% or more of the stocks of a foreign company (such as Kabusiki or Yugen Kaisya), you must file this form with accurate information on time. If you do not, you are subject to a $10,000 penalty each time, and a maximum of $60,000 penalty. [i].

If you view the form itself[ii], you understand how complex the form is. The majority of CPAs who handle individual income taxes are not familiar with form 5471, and this is exactly the danger zone you are in. - Subchapter F Income and Gilti tax

Subpart F income is codified under 26 U.S.C. 952. It involves CFCs(Controlled Foreign Corporations), that accumulate certain specific types of income. When a CFC has Subchapter F income under IRC Section 952, that means the U.S. shareholders may have to pay tax on the earnings. This may apply even if the income is never distributed to the shareholder. [iii].

Global Intangible Low-Taxed Income (GILTI) is earned abroad by U.S.-controlled foreign corporations (CFCs) and is subject to special treatment under the U.S. tax code. [iv].

Both Subchapter F and GILTI are difficult to comprehend even for international corporate tax accountants. Unfortunately, both may apply to you as an individual owning a foreign corporation. - Transactions with your Japanese company

As a shareholder, you receive dividends, salary, and/or Torishimari-Yaku (board of director) compensations. You must be alert to Japan and the U.S. taxation of such transactions thanks to the U.S. worldwide income reporting requirements by IRS. In addition, each of these items has a separate provision under the Japan-US Income Tax treaty. [v] You do not want to pay taxes twice for the same income. Also, you want to make sure you enjoy the reduced withholding tax rates under the treaty.

In short, you are dealing with three sets of rules (Japan tax, U.S. tax, and the tax treaty).

You also may have a loan from your company or you may want your company to purchase U.S. real estate on behalf of you. Again, these seem to be fairly simple transactions. However, when you are in the Subchapter F and Gilti tax regime, they can be complex. It may give you an unpleasant, and last-minute surprise email from your tax accountant in the U.S. - Final Words

To avoid unexpected tax payments and unnecessary tax penalties, you must hire a competent cross-border individual tax specialist and maintain constant communication with them, and have adequate tax planning before making your management decisions. The rules are complex, and they are changing every day. I am repeating the same message a few times in this article. I strongly feel that this message is indispensable to the readers.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/

[i] https://www.irs.gov/forms-pubs/about-form-5471

[ii] https://www.irs.gov/pub/irs-pdf/f5471.pdf

[iii] https://www.irsstreamlinedprocedures.com/subpart-f-income-cfcs-us-shareholders-foreign-earnings/

[iv] https://www.investopedia.com/global-intangible-low-taxed-income-gilti-definition-5097113

[v] https://www.treasury.gov/resource-center/tax-policy/treaties/Documents/japantreaty.pdf