Supporting cross-border life

A test called the Net Worth Test for exit taxes determines whether a global asset in your name exceeds $2 million or not as of the day before the permanent residence abandonment.

Those with defined benefit plans or annuities must know the fair market values of their pension and annuity when they abandon their green cards.

Defined-benefit pensions and annuities provide annual benefits for the person’s lifetime (until their death). No one can tell for sure what is one’s life expectancy. You probably know that you must use a specific table to determine the value.

I have not had the opportunity to provide any guidelines explaining this assessment method, so I summarized this point. I hope you find it helpful.

1, Defined benefit pensions and annuities

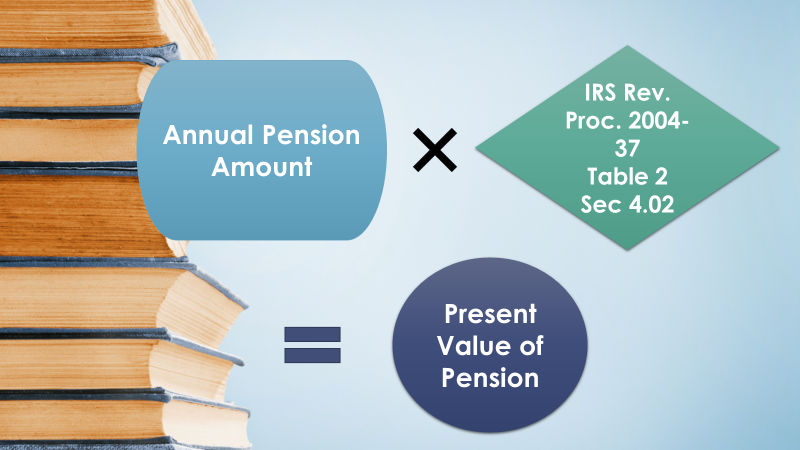

The value of defined benefit pensions in the exit tax is the present value of the future benefits, according to documents released by the IRS, and the valuation method is in the 4.02 Rev. Proc. 2004-37. [i]

It states that you must assess the value the day before the date of renounce of permanent residency. It would be best if you valued the annuity in the same way.

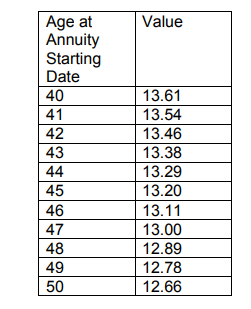

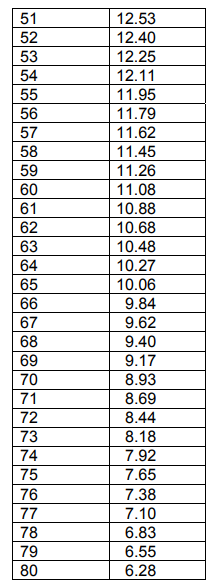

2, Table to be used[ii]

Here is the table that the IRS presents. This table assumes that you receive the same amount of benefit each month and shows the value of your plan, defined by multiples of annual benefits depending on the age at which you start receiving the benefits.

3, Example

Suppose A has a lifetime defined benefit pension that allows A to receive $5000 per month or $60,000 in benefits per year from age 65. The 65-year-old factor is 10.06 in the table above, so when A is 65, the value is calculated as $60,000×10.06=$603,600.

4, Points to consider

There are a few caveats. They are:

(1) If financial institutions value pensions and annuity and give you value, you must also refer to those numbers.

(2) In an annuity where the amount received changes every year, the assessment method is different.

(3) In addition, in the case of products that the spouse takes over or becomes life insurance, the calculation method changes.

(4) Finally, from a slightly different perspective, you cannot transfer your pensions without paying taxes to others. Be careful.

CDH provides tax filing services for cross-border US-Japan professionals and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intend to make it as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional for your specific case with specific circumstances.

I explained the same point on YouTube. Would you mind searching our channel called CDH Kaikei Jimusyo? We also offer free consultations. Would you mind making a reservation from this link? If you have any questions by e-mail, we will meet you and answer them online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s monthly newsletter, please do so at https://www.cdhcpa.com/login/

[i] Rev. Prc. 2004-37, Section 5 D

[ii] Rev. Proc. 2004-37.4.02