Supports Cross Border LifeStyle

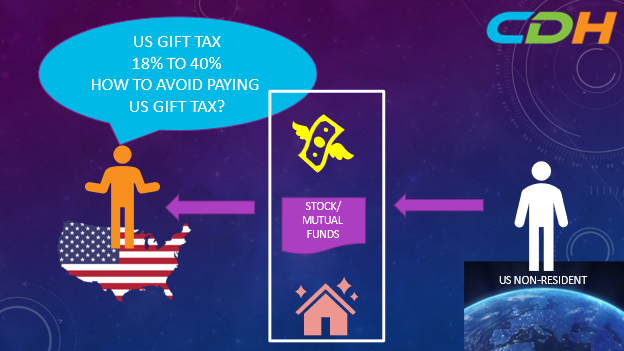

If your family members or friends who live overseas want to give you a gift, and you are a U.S. resident, there are a few things that you must keep in your mind. The purpose of this article is to explain these key points. In this article, I focus my discussion on the specifics of the U.S. taxation on the gifts from U.S. non-residents

- Cash

A gift of cash held in the U.S. is only subject to U.S. gift taxes. On the other hand, a gift of money kept elsewhere is not subject to U.S. gift taxes. A key but a little technical word is “situs.” “Situs” means the place to which a property belongs for legal jurisdiction or taxation. U.S. situs assets are only subject to the gift taxes for U.S. non-residents.

For example, I have a sister who lives in Japan. She is a U.S. non-resident. If she has a cash account at Chase in Chicago and gives that cash to me ( a U.S. resident), she is subject to U.S. gift taxes. In this example, the money at Chase is a U.S. situs asset. On the other hand, if she has a cash account at Mizuho Bank in Tokyo and gives that cash to me, she is not subject to U.S. gift taxes. Money at Mizuho is not a U.S. situs asset. I think she can either transfer the fund to my account in Japan or my checking account in the U.S.

- Stocks or Mutual Funds

Stocks or Mutual Funds are intangible assets (assets that do not have shapes) and are not subject to U.S. gift taxes. My sister can gift her stock holdings in her U.S. brokerage account or the same in her Japanese brokerage account to me without triggering U.S. gift taxes. In short, intangible assets gift from a U.S. non-resident does not trigger U.S. gift taxes.

- Real Estate

A house or a building, or a piece of land are tangible assets. If such a real estate asset is in the U.S., it is a U.S. situs property and is subject to U.S. gift taxes. On the other hand, if it is not in the U.S., it is not a U.S. situs asset and is not subject to U.S. gift taxes.

My sister can give me her house in Japan without triggering U.S. gift taxes. My sister cannot give me her condominium in Los Angeles without triggering U.S. gift taxes.

I want to leave a note of caution. Including you as a co-owner of the jointly-held property in the U.S. by a non-resident often results in gifting and triggers U.S. gift taxes. This is because the property in question is a U.S. situs asset.

- Final Words

A U.S. resident receives gifts from a non-resident. He may be subject to the U.S. reporting obligation. If the annual receipts exceed $100,000, he must file form 3520. If you are involved in a foreign trust or if you receive gifts from a corporation or a trust, there are other reporting rules to follow. The penalty is steep. In addition, there is an annual gift exemption of $16,000 in 2022. Japan has its annual gifting exemption, but the Japanese tax authority uses it differently.

Finally, this article focus only on the gifting from U.S. non-resident. This article does not cover gifts from U.S. residents. This article also does not cover U.S.estate taxes or foreign gift taxes.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues faced by these people are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, if you take action, consult with experts in tax and legal affairs.

CDH Resources https://www.cdhcpa.com/ja/personal-tax/ You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]