Support cross-border life

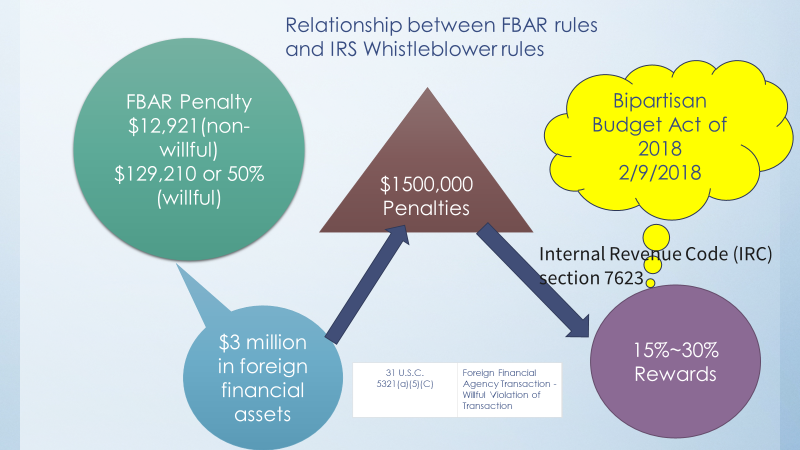

If IRS finds that you willfully did not report your foreign financial accounts in FBAR, under the 31 U.S.C. 532(a)(5)(c), the maximum penalty you face is higher of $129,210 or 50% of the amount in 2021. [i] This is a very serious penalty without questions. To avoid this penalty, many taxpayers try to hide their foreign financial accounts. Honest taxpayers opt to utilize the streamlined filing compliance procedures if they are not willful.

The United States enacted FATCA (The Foreign Account Tax Compliance Act). FATCA requires that foreign financial institutions (FFI) and certain other non-financial entities report on the foreign assets held by their U.S. account holders or be subject to withholdable payments. FATCA currently affects Japan’s financial institutions’ policies and procedures to a greater extent. For instance, it becomes almost impossible for a person without “My Number” (personal identification number issued by the Japanese government), you cannot have a bank account in Japan. To obtain such a number, you must be a bona fide resident. This means that even if you set up an account before you leave Japan, without My Number, you cannot move your money from your bank account in Japan.

On February 9, 2018, the U.S. Congress changed the law to include the FBAR related penalties to be covered under the IRS Whistleblower procedures. [ii] Under the program, a whistleblower may receive up to 30% of the penalties that the IRS recovered from the whistleblower’s claim. [iii] Individuals must use IRS Form 211 Application for Award for Original Information. It appears that the IRS will determine the significance of the claim to the corrected penalty, and determine the amount of the award. It also appears that there are two types of awards based on the size of the penalties and other factors. [iv]

Covid-19 affected the IRS just like it affected other private companies and government organizations. The overall processing speed deteriorated. However, I do not believe that IRS keeps strengthening its efforts to identify FBAR violators and collects penalties. With FATCA in place and the need for preventing money laundering from becoming more significant every day, I believe that the IRS whistleblower program will have a bigger impact in near future.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/.

[i] https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

[ii] https://constantinecannon.com/2020/01/10/t-tax-whistleblowers-collect-over-120-million-in-2019/

[iii] https://www.irs.gov/compliance/whistleblower-office

[iv] https://www.irs.gov/irm/part25/irm_25-002-002