Supports Cross Border LifeStyle

If you hold your green card for a certain period, you will remain a U.S. resident for tax purposes until you officially abandon your green card. I want to highlight significant mistakes you can avoid.

- Obtaining a green card and returning to your home country

Many came to the U.S. to receive higher education. Some choose to stay in the U.S. after graduating. Others may come to the U.S. for family reasons. They are likely to remain in the U.S. for a certain period. In the process, they obtain a green card (permanent residency status.)

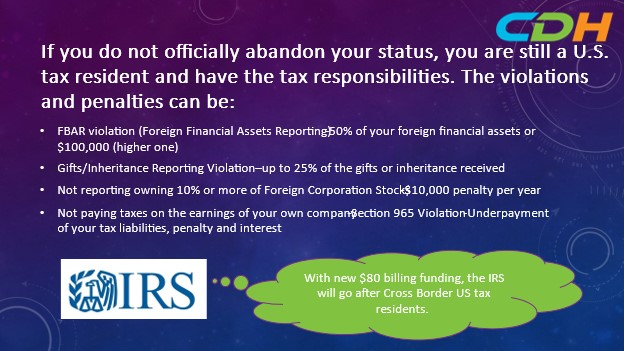

Some people with green cards may eventually return to their home countries to resume their lives. Unfortunately, many forget to abandon their green card status, resulting in hefty tax dues, penalties, and interest. First, you must file I-407 to USCIS with your green card. Second, you must file form 8854 with your last U.S. tax returns. Here are some of the issues that they may be facing.

- FBAR

If the IRS determines that you intentionally ignored the FBAR rules for not reporting your foreign financial accounts, the penalties can be 50% of the assets or $100,000, whichever is higher. Even if you unintentionally did not report the FBAR, you will face a $10,000 penalty each year for each overlooked account.

- Gifts/Inheritance from U.S. non-resident

If the annual amount of such exceeds $100,000 and you do not report it on Form 3520, you can lose 25% of the amount.

- 10% or more of owning non-U.S. corporation

If you do not report the facts to the IRS on Form 5471, you will face a $10,000 penalty per year.

- Earnings of your non-U.S. corporation

If you own a non-U.S. corporation as a green card holder, you may face taxes on the earnings of the such company even if the company does not distribute dividends to you. The IRS has section 965 to govern this rule. You may also face severe penalties and interest because you did not pay taxes to the IRS.

With the future funding of $80 billion, the IRS will most likely have enough resources to go after cross-border professionals like you. Before leaving the U.S., I strongly recommend you consult with tax professionals. If you think you are violating the U.S. tax rules, I also recommend you take immediate action to correct your mistakes.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues faced by these people are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, if you take action, consult with experts in tax and legal affairs.

CDH Resources https://www.cdhcpa.com/ja/personal-tax/ You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can contact [email protected]. We are looking to hire those who aspire to build their careers in cross border individual tax field. Please get in touch with us if you are interested.