As the tax season rolls around in April, many newlyweds find themselves navigating the complexities of filing their first tax return together. This is particularly true for international couples, such as Hana, a green card holder from her marriage to an American citizen, Max, and their unique journey from a dream honeymoon in Denmark to facing the intricacies of U.S. tax laws.

Hana and Max, who share a passion for exploring culinary delights, embarked on their marriage with a memorable trip to Denmark, aiming to dine at the renowned restaurant Noma, which is said to be the hardest to get a reservation in the world. Despite the challenges in securing a reservation, their persistence paid off, mirroring the determination they would soon need in tackling their first income tax filing.

In the U.S., couples have several filing status options: Single, Married Filing Jointly (MFJ), Married Filing Separately (MFS), Head of Household (HOH), and Qualifying Widow(er) with Dependent Child (QW). For Hana and Max, who were married by December 31 of the previous year, the choice boils down to Married Filing Jointly or Married Filing Separately.

Many international couples might lean towards joint filing, as it often simplifies the process and can lead to better tax benefits. However, the decision should not be taken lightly, as each status offers distinct advantages and implications, especially for couples with diverse financial backgrounds or international assets.

The MFJ status generally provides more favorable tax rates and higher income thresholds for tax brackets, potentially leading to significant tax savings. It also allows couples to claim various deductions and credits that may not be available if filing separately. However, joint filing means both spouses are jointly and severally liable for the tax return, including any errors or omissions.

On the other hand, MFS might appeal to couples who wish to keep their finances separate or when one spouse has significant medical expenses, miscellaneous deductions, or potential tax liabilities. This status might also be beneficial for individuals who wish to maintain privacy over their financial matters, such as Hana, who hesitated to disclose her Japanese financial accounts to Max since the couple had only recently been married and had not had a chance to talk about each other’s assets.

For international couples, the choice of filing status is further complicated by the need to consider global income and assets. The U.S. taxes its residents and citizens on their worldwide income, necessitating full disclosure of foreign bank accounts and assets when filing jointly.

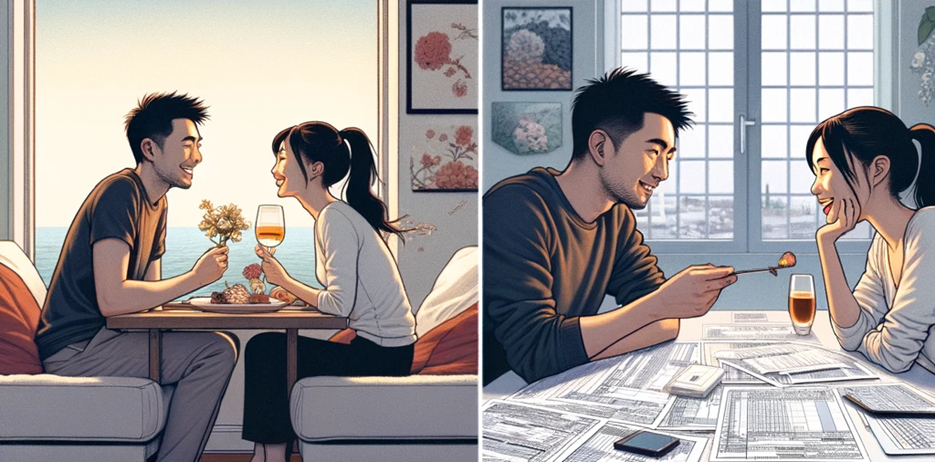

Before making a decision, it’s crucial for couples to discuss their financial situations openly. Hana saw this moment as the perfect chance to engage in an open dialogue with Max for the first time. Reflecting on a new restaurant she had been eager to try, Hana realized they could leverage their shared passion for dining as a means to navigate this challenge together. This approach not only aids in making an informed decision about their tax filing status but also strengthens their bond by fostering transparency and trust in financial matters.

International married couples must weigh their options carefully when choosing their filing status. Consulting with a tax professional who understands the nuances of international taxation can provide valuable insights and help couples like Hana and Max make the best decision for their unique circumstances. As they continue their journey together, understanding and managing their financial health becomes a cornerstone of building a strong and enduring partnership.

——-

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various daily problems and questions. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So, there are many exceptions. If you act, be sure to consult with a tax and legal professional.

We offer free consultations: https://outlook.office365.com/owa/calendar/[email protected]/bookings/

Email inquiries: [email protected]

Subscribe CDH’s newsletter: https://www.cdhcpa.com/login/