Supports Cross Border LifeStyle

What are the tax differences between a U.S. citizen and a green card holder? This question is one of the frequently asked questions. I want to shed some light on this article’s seemingly simple but complex and profound question.

- Income Tax Rules

U.S. citizens and Green card holders are both U.S. persons. In simple terms, both are U.S. residents wherever they are. There are no differences between being a U.S. citizen and a green cardholder. As far as the income rules, there are no differences.

2. Gift and Inheritance(estate tax) Rules

The significant differences lie in the gift and inheritance (or estate) rules. In my opinion, there are a few differences. In this article, I want to only focus on the issue of domicile.

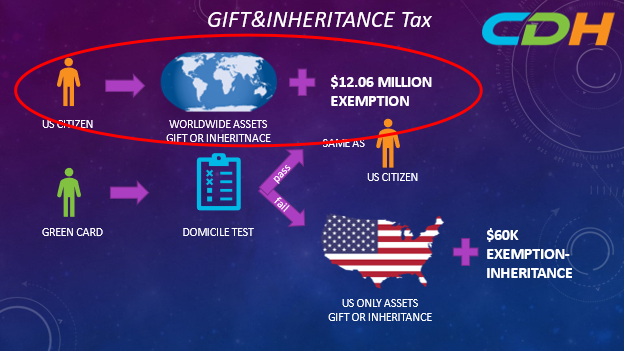

If you are a U.S.citizen, you are U.C. domiciled individual per the definition. The federal government taxes your worldwide gift and inheritance transactions. In other words, your worldwide assets are subject to the U.S. gift and inheritance tax rules. Does it sound gloomy? Not really. Because you are a U.S. domicile, you are entitled to the unified credit. The unified tax credit gives a set dollar amount that an individual can gift during their lifetime and pass on to heirs before any gift or estate taxes apply. The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate, dollar for dollar. The lifetime exemption for 2022 is $12.06 million. Most people do not have to worry about paying taxes. Please note that the amount of the unified credit changes each year. It may decline in the future. No one knows for sure.

If you are a green card holder, you must review the facts and circumstances of your connection to the U.S. as a permanent home. There is no simple way of analyzing this. Domicile is where a person has their permanent home and substantial connection. Another condition is the state of your mind. You must intend to stay there permanently. If you are a U.S. domicile, your situations are the same as that of a U.S. citizen.

If you are not, two things happen. The U.S. government taxes only U.S. situated assets (the technical term is U.S. situs assets). You do not have the unified credit available. As far as the estate tax is concerned, the exemption is $60,000. The good thing is that the U.S. government only cares about the assets in the U.S., but at the same time, you do not have an extensive exemption of the unified credit. Yours is a $16,000 annual gift exemption in a gifting situation. Anything above this amount is taxable. The current tax rate ranges from 18% to 40%.

There are intricacies about U.S. situs assets under gift and estate tax systems. In addition, the tax treaty governing gifting and estate taxes is beyond the scope of this article.

To find out if you are the U.S. domiciled, I recommend that you consult with an excellent professional. If you have a cross-border lifestyle, this is especially true. The tax impact can be substantial based on your domicile.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues faced by these people are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, if you take action, be sure to consult with experts in tax and legal affairs.

CDH Resources https://www.cdhcpa.com/ja/personal-tax/ You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it.