Supports Cross Border LifeStyle

When a U.S. resident leaves appreciated assets to his heir, the heir will not pay taxes in most cases. A U.S. resident can take advantage of his unified credit ($12.06 million for 2022), and the heir can take advantage of the step-up basis (or stepped-up basis) rule. The step-up basis happens when the price of an inherited asset on the date of the decedent’s death is above its original purchase price. The U.S.tax code allows for raising the cost basis to the higher price, minimizing the capital gains taxes owed if the asset is sold later.

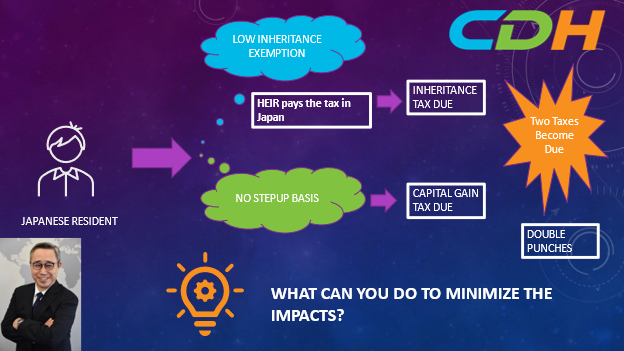

In this article, I illustrate a case where an heir is a Japanese resident, and if so, what happens. First, the basic exemption of the Japanese inheritance tax is exceedingly low (in my view.) If I use an outdated exchange rate of $1 equals 100 yen, the basic exemption starts at $360,000—the amount of the exemption increases based on the number of the legally designated heir. Consequently, many end up paying inheritance tax to the Japanese government. In this case, the Japanese government can tax worldwide inheritance receipts because the heir lives in Japan.

Secondly, Japan does not have the step-up basis rule of inheritance. When an heir receives an asset, the asset’s cost is the same as the cost of the deceased’s purchase. Often, an heir must sell appreciated assets to pay the Japanese inheritance tax. Japan does not have a probate system. But, the U.S. does. When the heir, in this case, sells the U.S. assets with gain, he must pay the capital gain tax in Japan.

In short, the heir in Japan must pay both capital gain tax and inheritance tax. Consequently, his net proceeds will be much less than the case the heir lives in the U.S. One additional headache is that an heir cannot monetize the assets if the U.S. assets are in probate. Japan Tax Authority, however, does not wait until the probate process is over.

How can the heir avoid this seemingly disastrous situation? There is no magic cure for sure. But, there are several things that you can consider:

- Make certain U.S. resident keeps the cost information of the real estate and subsequent improvements

- Make sure U.S. resident holds a record of the cost of securities

- Use the U.S./Japanese gift tax rules to shift the assets to the person in Japan gradually

- Set up a living trust to make sure that the assets go to the Japanese resident w/o probate

- Monetize the assets in the U.S. and transfer them to Japan, and keeps them there

- Others (including contacting CDH for advice)

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues faced by these people are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, if you take action, consult with experts in tax and legal affairs.

CDH Resources https://www.cdhcpa.com/ja/personal-tax/ You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]